International

Stocks stumble to end ‘miserable’ 2022

| By AFP | Roland Jackson |

Stock markets wrapped up their worst performances in years on Friday before heading into 2023 under recession fears following Russia’s invasion of Ukraine, high inflation and rising interest rates.

Both US and European indices closed their final sessions of the year in the red.

For the year, Frankfurt was down more than 12 percent and Paris lost 9.5 percent for their worst performances since 2018. London, however, was up 0.9 percent in 2022 as the energy sector was buoyed by soaring energy prices.

Wall Street saw its worst annual drop since 2008, with the S&P 500 index down around 20 percent and the tech-heavy Nasdaq losing about 30 percent for the year.

Equities were slammed as the US Federal Reserve, European Central Bank and Bank of England aggressively lifted interest rates in a bid to tackle rampant consumer price rises. The move carries the risk of sparking recession as higher borrowing costs slow economic activity.

US tech companies were hit particularly hard as they are usually boosted by lower interest rates.

The MCSI World Equity Index has lost almost a fifth in its worst annual performance since 2008, when markets were ravaged by the global financial crisis.

Asia-Pacific markets finished their last sessions mostly in the green on Friday.

But for the year, Hong Kong tanked 15.5 percent and Shanghai dived 15.1 percent in the biggest annual slumps since 2011 and 2018, respectively.

Covid spiked once more in China in December, after Beijing relaxed its strict curbs in the face of rare public outcry. The surge has also prompted worries about the impact on stretched global supply chains.

Tokyo plunged 9.4 percent in the first annual fall since 2018 but the Bank of Japan maintained its ultra-easy monetary policy, in contrast with other central banks, to help its fragile economy.

‘Pitiful end to miserable year’

“It’s shaping up to be a pitiful end to a miserable year in stock markets,” OANDA trading platform analyst Craig Erlam told AFP.

He said 2022 had “brought an end to an era” of low interest rates that fueled tech and crypto booms.

“That’s been replaced with soaring inflation and interest rates, immense economic uncertainty and the reshaping of energy markets in the aftermath of the Russian invasion of Ukraine,” Erlam added.

In commodities, oil prices rallied in 2022 with Brent gaining about 10 percent and the West Texas Intermediate adding around seven percent.

However, they remain significantly below peaks struck in March on supply woes after key producer Russia invaded its neighbor, sending natural gas prices also spiking.

Britain and other major economies now face the likely prospect of grim recessions next year, as consumers and businesses battle rampant inflation and rising rates after years of ultra-low borrowing costs.

“The most important take of the year is: the era of easy money ended, and ended for good,” noted SwissQuote analyst Ipek Ozkardeskaya.

“And given that there is still plenty of cheap central bank liquidity waiting to be pulled back, the situation may not get better before it gets worse,” she said.

“Recession, inflation, stagflation will likely dominate headlines next year.”

London was down 0.8 percent and Frankfurt shed 1.1 percent in half-day sessions ahead of the New Year holiday. Paris closed 1.5 percent lower.

On Wall Street, the Dow ended 0.2 percent lower while the tech-heavy Nasdaq shed 0.1 percent.

“It would appear that people have checked out for the year — and have settled back into holiday mode for New Year celebrations,” Erlam said.

Key figures around 2145 GMT

New York – Dow: DOWN 0.2 percent at 33,147.25 (close)

New York – S&P 500: DOWN 0.3 percent at 3,839.50 (close)

New York – Nasdaq: DOWN 0.1 percent at 10,466.48 (close)

London – FTSE 100: DOWN 0.8 percent at 7,451.74 (close)

Frankfurt – DAX: DOWN 1.1 percent at 13,923.59 (close)

Paris – CAC 40: DOWN 1.5 percent at 6,473.76 (close)

EURO STOXX 50: DOWN 1.5 percent at 3,793.62 (close)

Tokyo – Nikkei 225: FLAT at 26,094.50 (close)

Hong Kong – Hang Seng Index: UP 0.2 percent at 19,781.41 (close)

Shanghai – Composite: UP 0.5 percent at 3,089.26 (close)

Euro/dollar: UP at $1.0704 from $1.0667 on Thursday

Pound/dollar: UP at $1.2094 from $1.2062

Euro/pound: UP at 88.47 pence from 88.40 pence

Dollar/yen: DOWN at 131.11 yen from 132.96 yen

West Texas Intermediate: UP 2.4 percent at $80.26 per barrel

Brent North Sea crude: UP 2.9 percent at $85.91

International

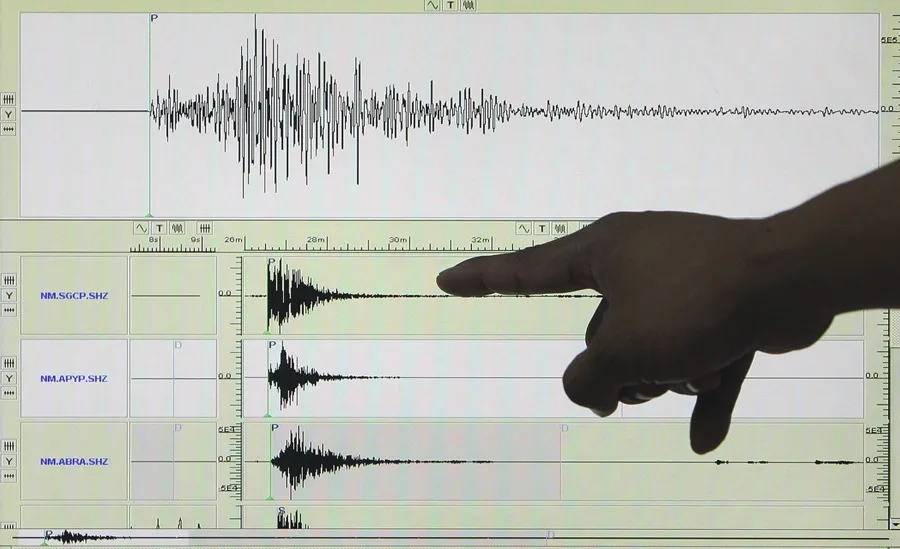

A magnitude 6 earthquake shakes the province of Esmeraldas in Ecuador, bordering Colombia

A magnitude 6 earthquake was recorded this Friday in the coastal province of Esmeraldas, bordering Colombia, causing damage to several infrastructures and leaving, so far, 20 people injured.

According to the Geophysical Institute of the National Polytechnic School, the earthquake occurred at 06:44 local time (11:44 GMT) at 1.03 degrees south latitude and 79.69 degrees west longitude.

According to the source, the tremor occurred at a depth of 30 kilometers and 9.31 kilometers from Esmeraldas, capital of the homonymous province.

According to the National Secretariat of Risk Management (SNGR), the affected people had head injuries and bruises.

While the SNGR continues with the verification of affectations, it indicated that 80% of the electricity service and 80% of the telecommunications that were affected, are gradually restored.

Among the affected public buildings are the ECU 911 due to a fall of masonry; the Vargas Torres University, which has cracks; the Los Militares building where the front collapsed and the Prefecture building, among others.

The SNGR reported that the earthquake was felt with strong intensity in seven municipalities of the province of Esmeraldas and moderately in the provinces of Guayas and Manabí, while mildly in Carchi, Cotopaxi, Imbabura, Los Ríos, Pichincha, Santo Domingo de los Tsáchilas and Tungurahua.

About twenty minutes after the earthquake in Esmeraldas, one of magnitude 4.1 was reported in the coastal province of Guayas, located in the southeast of the country, without damage or victims having been reported so far.

The President of Ecuador, Daniel Noboa, ordered the displacement of all his ministers to Esmeraldas, in order to coordinate actions after the magnitude 6 earthquake recorded this Friday.

“I have arranged for the immediate deployment of all ministers in the province of Esmeraldas to coordinate the installation of shelters, delivery of humanitarian aid kits and assistance in everything our people need,” Noboa wrote on his social network account X.

The province of Esmeraldas was one of the most affected by the 7.8 magnitude earthquake recorded on April 16, 2016, which left more than 670 dead, thousands affected, as well as millions of material losses.

This earthquake also hit the province of Manabí, located, like Esmeraldas, on the coast of the Andean country, but also affected other areas and was felt strongly, even in the Ecuadorian capital.

Ecuador is located in the Pacific Ring of Fire or Belt, which concentrates some of the most important subduction areas (sinking of tectonic plates) in the world and is the scene of strong seismic activity.

In addition to Ecuador, the Horseshoe-shaped Belt comprises a large number of countries such as Chile, Argentina, Bolivia, Peru, Colombia, Panama, Costa Rica, Nicaragua, El Salvador, Honduras, Guatemala, Mexico, the United States and Canada.

International

Preparations for Pope Francis’ funeral, in figures

The funeral of Pope Francis this Saturday, the first of a reigning pontiff for two decades, is an event that moves dizzying figures and will require the full mobilization of Italian authorities and volunteers.

These are some of the figures that draw what can be expected tomorrow for a historic day:

The Italian Ministry of the Interior has calculated that 200,000 faithful will attend the funeral of Francis. For the next conclave – with a date yet to be defined – and the election of the new pope, that figure amounts to 250,000.

The funeral procession that will move the remains of the late pope from St. Peter’s Vatican to the Basilica of Santa María la Mayor, where Francis arranged to be buried in a simple tomb.

3,000 volunteers will mobilize the Italian Civil Protection, responsible for the management of the preparations. There will be 55 health teams distributed throughout the funeral procession between San Pedro del Vaticano and the basilica de Santa María la Mayor, in addition to 11 advanced medical posts and 52 additional ambulances that will join the existing fleet.

17 degrees and a radiant sun are expected at 10:00 (08.00 GMT) on Saturday, the start time of the funeral, although the thermometer could reach 24 degrees throughout the day.

The state group Ferrovie dello Stato makes 260,000 seats available to those who wish to approach Rome by train. Civil Protection also confirmed that 500 parking spaces for buses and coaches have been reserved for the same day in Rome and its surroundings.

130 international delegations have already confirmed their presence at the event, but it is expected that the final figure may rise to 170. Fifty will be headed by heads of state or government, including a dozen sovereigns.

120,000 arrivals planned in Rome on April 25 and 26, which will translate into about 320,000 overnight stays, according to figures from the Department of Tourism of the Italian capital, which warns that the estimates may be below even those that finally occur. 101,000 of those arrivals will take place in hotels and another 53,000 in “supplementary establishments”.

11,000 soldiers and members of the security forces, not counting the teams of the international delegations, who will ensure that the funeral is held without incident. Police, police officers and traffic officers will join at least 1,500 soldiers.

5 anti-drone bazooas, capable of intercepting the radio frequencies with which these devices are operated, which will reinforce the decreed no-fly zone over the Roman sky.

International

“A dignified life” for migrants, the plea in Panama in memory of Pope Francis

Catholics who work with some of the 299 migrants deported by the United States to Panama, beg the Government that beyond placing the flag at half-mast for the death of Pope Francis this week, it should pay tribute to him by giving “a dignified life” to the migrants, as the Supreme Pontiff preached.

“Never forget your human dignity,” because “you are not a discard,” the pope wrote last year in a message addressed to the thousands of migrants who had just crossed the dangerous Darién jungle, the natural border between Colombia and Panama, on their way to the United States.

Known by many as “the pope of migrants” for his defense of those who are forced to leave their land in search of better living conditions, he himself recalled then that he was “son of migrants who went out in search of a better future,” and that “there were times when they were left with nothing, until they went hungry; with empty hands, but their hearts full of hope.”

Therefore, members of Catholic organizations that are part of the CLAMOR Network (the Latin American and Caribbean Ecclesiastical Network for Migration, Displacement, Refuge and Trafficking in Persons), and who work with dozens of migrants in the Panamanian capital deported by the United States, remember the teachings of Pope Francis.

Elías Cornejo, coordinator of social promotion and attention to the migrant population of the Catholic organization Fe y Alegría, which is part of the Clamor Network, explained to EFE in a migrant shelter that we must “look for alternatives for these people, they cannot be kept in conditions that are not favorable or dignified.”

“In the context of the death of Pope Francis, who was incisive in insisting on humane treatment of migrants, I believe that this country that declares itself mostly Catholic (…) beyond the flag at half-mast, I would also ask the national government to dignify that memory of Pope Francis by giving an answer to many people who (…) have the right to have a dignified life,” Cornejo stressed.

“Give them that, try to find a human, Christian, evangelical answer,” he insisted.

The pilgrimage of this group of migrants through Panama began in mid-February, when a total of 299 arrived on three planes from the United States within the framework of an agreement that turned the Central American nation into a “joup” country for their repatriation.

Coming from extracontinental nations such as China, Afghanistan, Sri Lanka, Vietnam, Uzbekistan, Cameroon, Ethiopia, Iran, Russia, Pakistan or Nepal, 188 returned to their countries “voluntarily”, according to the latest official information available, and 111 refused to do so, many of them fearing for their lives.

The entire group was first housed in a central hotel in the Panamanian capital, and those who refused to be repatriated to their countries were transferred to a shelter more than 200 kilometers away, near the Darién jungle.

Then, after the decision last March by the Government of Panama to grant them a temporary humanitarian permit for 30 days, extendable up to 90, to find a way out of their situation, they took them back to the capital, although now without any type of logistical support, so the CLAMOR Network occupied that vacuum by first hosting the migrants in a humble hotel in the city, to transfer them days later to one of its shelters.

According to Cornejo, who underlines the support they receive in the shelter of “non-believing people, believing people, Muslim people, people of other religions too,” of the 69 migrants who moved there – families with children continue to stay in a hotel – 47 remain, since they “make their own decisions and move” by their own decision to other places.

“We don’t know where, we have an idea, but we don’t want to keep them or force them to anything, because they are free, they are not people who are imprisoned (…) We don’t want to pressure them, we don’t want to pressure the Government, but we do want to tell them again, ‘please, let’s find a way out of this’. An exit that has to be worthy for the State and for them, for migrants,” he remarked.

At least, he says, from the Foreign Ministry they have guaranteed that they will not deport anyone by force if the new 60-day period ends, an extension that ends in June and that, according to official data shared with EFE, at least 80 migrants have requested.

Two mothers from Asian countries who requested with their children the extension of the “temporary resident permit for humanitarian reasons”, as indicated in the document to which EFE had access, and who asked for anonymity, insisted that returning to their country is not an option, since if they return their “lives are in danger”.

Housed in a humble hotel in the center of the Panamanian capital, on a floor where behind each door there is a family of different nationality, they explain to EFE through a translation application part of their journey to the United States, crossing several countries of America with their minor children, and then their sudden expulsion without knowing the destination, some handcuffed hand and foot.

“When they put me on the plane I felt suffocated. His hands and feet were cold. My heart was beating fast, I had high blood pressure. I told the military,” recalls one of them. There were men and women handcuffed, the children were terrified. They are adults, but children are not, “how can they treat them as criminals?”

Now, they say, they are “afraid” that the day will come when the deadline they were given to stay in Panama will expire. “When this document ends, I don’t know exactly what will happen to us if the United States doesn’t get us out of here.”

“We want to ask Donald Trump to return us to the United States, please,” they begged.

-

Central America4 days ago

Central America4 days agoCardinal Rodríguez to Attend Funeral of Pope Francis: “He Was Very Dear to Me”

-

Central America4 days ago

Central America4 days agoNicaragua’s Ortega and Murillo Mourn Pope Francis, Acknowledge ‘Difficult’ Relationship

-

International4 days ago

International4 days agoDominican Republic Declares Three Days of Mourning for Pope Francis

-

International4 days ago

International4 days agoDHS Secretary Kristi Noem’s Purse Stolen in D.C. Restaurant Heist

-

International3 days ago

International3 days agoPope Francis and Trump, a relationship of disagreements marked by migration

-

International3 days ago

International3 days agoFrom the transfer of the coffin to the funeral, three days to say goodbye to Pope Francis

-

International3 days ago

International3 days agoWithin Francis’ private wake: respect and prayer for the deceased pope

-

International4 days ago

International4 days agoPope Francis: The Quiet Architect Behind the U.S.-Cuba Thaw

-

International3 days ago

International3 days agoA very heterogeneous and divided conclave will elect the new pope

-

International3 days ago

International3 days agoTrump’s emissary will visit Russia this week for consultations on the arrangement in Ukraine

-

International3 days ago

International3 days agoModi returns to India and shortens his visit to Saudi Arabia after a deadly attack in Kashmir

-

International3 days ago

International3 days agoCardinal Becciu’s enigma: will he enter the conclave?

-

International3 days ago

International3 days agoThe pope last called the Gaza parish on Saturday and asked about the children

-

International3 days ago

International3 days agoA candidate for the Supreme Court denounces an unequal dispute in the judicial election of Mexico

-

International3 days ago

International3 days agoAmerican universities and colleges sign a letter against Trump’s policy

-

International3 days ago

International3 days agoThe Government of Colombia presents twelve questions that it will propose in a popular consultation to promote its reforms

-

International3 days ago

International3 days agoBurma’s military junta extends ceasefire until April 30 due to the earthquake

-

International3 days ago

International3 days agoEl Salvador formalizes the proposal for the exchange of Venezuelan deportees, according to Bukele

-

International10 hours ago

International10 hours ago“A dignified life” for migrants, the plea in Panama in memory of Pope Francis

-

International3 days ago

International3 days agoThe Peruvian Public Ministry denounces the former attorney general for an alleged corruption case

-

International1 day ago

International1 day agoThe Arab League supports Hamas handing over control of Gaza and weapons to the Palestinian Authority

-

International1 day ago

International1 day agoThe Pope’s funeral procession through the center of Rome worries the Italian authorities

-

International3 days ago

International3 days agoMaradona’s house arrest is again a focus of tension in the trial for his death

-

International3 days ago

International3 days agoA judge orders the Trump Government to restore Voice of America services

-

International3 days ago

International3 days agoDonald Trump will visit Saudi Arabia, Qatar and the United Arab Emirates in mid-May

-

International3 days ago

International3 days agoRoyal quinoa, the superfood that grows in front of the largest salt flat in the world in Bolivia

-

International3 days ago

International3 days agoInternational leaders begin to confirm their presence at Pope Francis’ funeral

-

International3 days ago

International3 days agoChurch charges ceased or resigned in the papacy of Francis for cases of pedophilia

-

International3 days ago

International3 days agoThe president of the World Bank underlines his intention to lift his veto on nuclear energy

-

International1 day ago

International1 day agoMigrants want to stay on Mexico’s southern border because of Sheinbaum’s industrial plan

-

International10 hours ago

International10 hours agoA Russian general dies in the explosion of a car bomb near Moscow

-

International1 day ago

International1 day agoA group of the poor and a delegation of migrants will participate in the funeral and burial of the pope on Saturday

-

International3 days ago

International3 days agoMarco Rubio reorganizes the State Department to eliminate offices and jobs

-

International3 days ago

International3 days agoThe Brazilian Supreme Court opens trial against six others accused of leading the coup attempt

-

International1 day ago

International1 day agoThe pope’s doctor reveals his last moments of life and that he wanted to “die at home”

-

International1 day ago

International1 day agoFrom email to marriage: the day Pope Francis married a Uruguayan couple

-

International10 hours ago

International10 hours agoA magnitude 6 earthquake shakes the province of Esmeraldas in Ecuador, bordering Colombia

-

International3 days ago

International3 days agoA judge in the United States stops the deportation to El Salvador of a hundred Venezuelans

-

International10 hours ago

International10 hours agoPutin and Witkoff address possible direct negotiations between Russia and Ukraine

-

International10 hours ago

International10 hours agoPope Francis’ funeral procession will be a six-kilometer journey through the heart of Rome